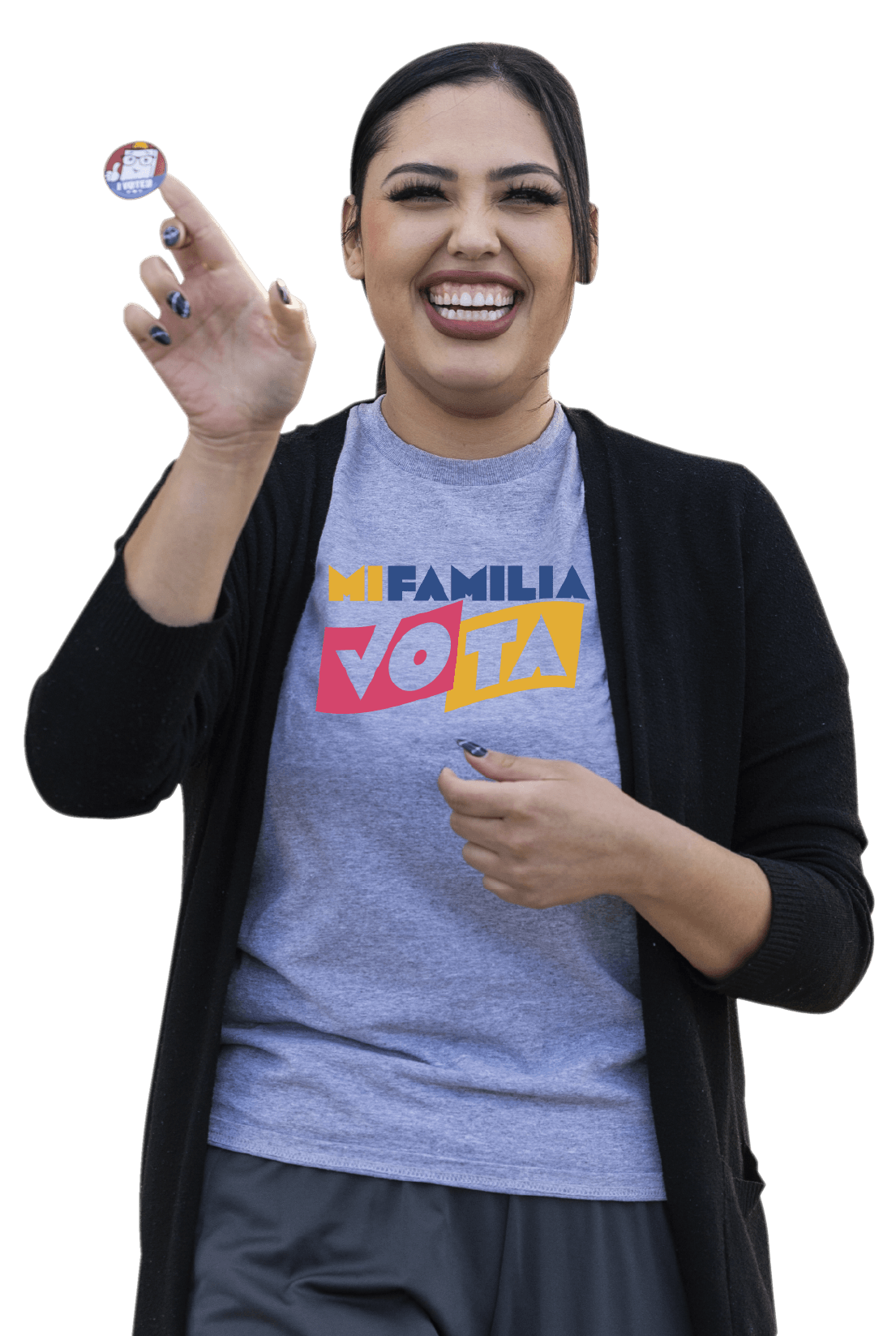

Mi Familia Vota: Great Place to Work

Mi Familia Vota is fighting for a future where Latino voices shape and advance policies that promote the health, safety, and prosperity of Latino communities across the country. Fighting for our communities means fighting with our communities. That is why we stand firm in our commitment to organize, educate, and mobilize our people to make…